Understanding your payslip is easier than it sounds. Always keep your payslips safe, and use this beginner’s guide to know what you’re being paid and why.

The Department for Business Spring 2019 poll on payslip awareness shows that 62% of workers don’t understand their payslip. That’s a big number, but the news is no big surprise. When you get your first payslip, who’s going to sit down and explain it to you? The answer is often ‘no-one’ – and it’s usually because even your line manager might not really understand what’s written down, either!

What is a payslip?

Employers give you a payslip every time you get paid. It sums up what you’ve earned and what’s been deducted or taken away. Wait – your earnings might be taken away? Don’t panic. It’s not being stolen. You might get money taken from your salary for things like your tax, student loan, National Insurance, or money you’ve chosen to put into a pension. It’s legit – but it’s still good to check the numbers and make sure you are being paid what you are owed.

Your payslip will normally be on a piece of paper. Some places will give you an online payslip instead. You can still download it and keep it safe.

Who gets a payslip?

If you are an employee or even casual staff you have the right to a payslip when you get paid. Your payslip gives details in writing of things like your gross pay, net pay and payroll number. We’ll explain this jargon in a bit. If you’re working freelance, you don’t get a payslip – it’s up to you to keep your tax info up to date.

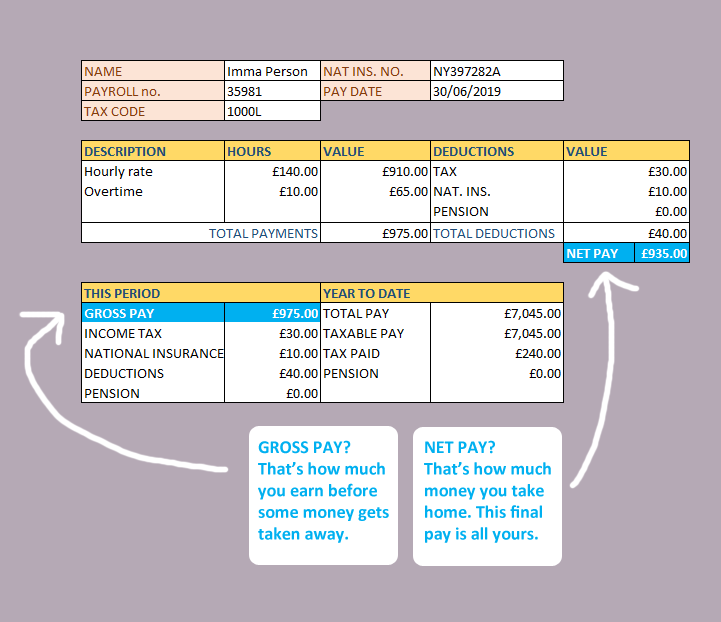

Payslip example

What do payslips show?

Every payslip HAS to show this important information:

- Your pay before any deductions have been made (‘gross’ wages)

- Deductions from your pay (like tax and National Insurance)

- Your final take-home pay after deductions have been made (‘net’ wages)

- How many hours you’ve worked, if your pay varies depending on time worked

Payslips MAY also show this useful information:

- Your tax code (the government uses this to track your tax payments over the years)

- Your National Insurance number (you’ll have this number all your life. You need an NI number to work in the UK)

- Your pay rate (how much you earn every year or hour)

- Extra payments (overtime, expenses, tips or bonus extras will appear in your final gross pay)

- Your payroll number (your employer might use a number to identify you on their payroll)

Understanding your payslip – jargon buster

Payroll number

Sometimes your payslip will show a number used by your employer’s company to identify people on their payroll. A payroll is a fancy word for a list of people being paid.

Gross pay

This is how much it looks like you’ve been paid. It’s the big number, before any deducations like tax, National Insurance or student loans come out. The German word for ‘big’ is ‘gross’, so this is the ‘big’ number.

Net pay

This is what you actually get paid. It’s your gross (big) pay, minus any deductions. It’s also known as ‘take home’ pay. You can remember it as the money you actually caught in your net to take home – that’s why it’s your ‘net’ pay.

Payslip date

This is the date on which any money you have earned should go through to your bank account.

Tax code

This is a code given to you by HM Revenue & Customs (HMRC). Your tax code tells your employer how much tax-free money you are allowed to earn before you get tax deducted from the rest. This tax code needs to be correct so you end up paying the Goldilocks amount of tax – not too little, not too much, but just the right amount. You can check your tax code against your most recent tax code letter from HMRC.

In 2019-20 you get a tax-free allowance of £12,500. This means you can earn up to £12,500 and not pay tax on it. You will have to pay tax on anything you earn over that.

National Insurance (NI) number

You are given an NI number when you are born and will have it for your whole life. You need it to work in the UK. It’s your own personal number for the social security system. It means you can build up what state benefits you can have. For example, because you pay your National Insurance contributions, you get a pension when you retire one day.

Student loan

If you’re paying off a student loan, this gets shown on your payslip. As an employee of a company you will usually start paying it off from the April after the date you graduate (or leave your course). HMRC tells your employer how to take off the right amount from your salary to go towards your student loan. HMRC also tells the Student Loans Company what you have repaid.

Basically, HMRC does all the heavy lifting. What you need to do is keep your payslips and P60 safe. You will need these if you have any problems with your student loan and want to talk to someone.

Tax period

You might see a tax period number on your payslip. If you do, the number changes to say which tax period you are in. For example, if you get paid monthly, 01 is April and 12 is March. That is because the tax year begins and ends in April. The tax year starts on April every year, not January 1st!

Got more payslip questions?

Head on over to this great roundup from the Money Advice Service. It gets into even more detail about your payslips – because there’s a lot more to say.

If you get stuck, here’s what’s important when it comes to understanding your payslips:

- Know what your gross pay is

- Know what your net pay is

- Check your payslip uses the right tax code

- Keep your payslip and P60 safe. You will need them in the future!