Labour Market Outlook

This week the Chartered Institute of Personnel Development (CIPD) launched their latest Labour Market Outlook (LMO). Produced in partnership with Adecco it provides market indicators for employers’ recruitment, redundancy and pay intentions. This quarters report holds considerations on the impact of the National Living Wage and the Brexit effect.

Taken from responses of 1,051 employers the data is also compared against the latest ONS data (January).

The labour market is continually shifting with economic, social and political forces changing the way that employers do business and impacting how they attract, develop and keep the best talent within their organisations. The CIPD offer their insight and commentary, with the full LMO report available here.

Employment

The report indicates that the outlook for short-term employment remains strong. The net employment balance (the difference between the amount of employers who expect to increase staff levels and those who expect to decrease staff levels) has increased to +23 from +22 last quarter. The CIPD note that expectations among services firms and healthcare firms has fallen slightly in the last three months whilst confidence in the manufacturing sector has strengthened.

Official data shows that the vacancy numbers remain above average with evidence suggesting that these are concentrated in low skilled sectors such as wholesale and retail, accommodation and food services along with social work. On top of the this it is noted that almost three in ten employers say that non-UK nationals from the European Union considered leaving their organisation in the six months to December 2016. The CIPD go on to suggest that employers’ increased difficulty with finding suitable candidates may have been concentrated in some services sub- sectors and may worsen in the years ahead. Skill and labour shortages may be exacerbated by specific reasons relating to these types of roles particularly around the perceptions of the role anti-social hours or poor working conditions.

“This is perhaps no surprise given the underlying trend in employment and unemployment and tentative signs of a fall in the growth in the number of non-UK nationals from the European Union in employment; who have tended to be associated with those sectors that report the highest number of vacancies, such as retail and accommodation and food services”

With the potential issues in labour supply it remains to be seen whether the expected employment growth will come to fruition. The CIPD note that this might put further pressure on pay in the year ahead.

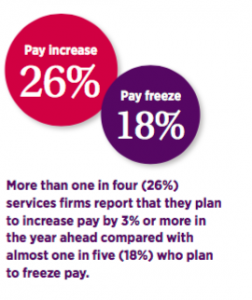

Pay

Inline with the official data the outlook on pay has modestly increased. According to the LMO report, median basic pay expectations for the 12 months to December 2017 have increased to 1.5% from 1.1%. The CIPD note that inflation is the main factor behind basic pay expectations increasing. They go on to note that it seems likely that real wage growth will be very low or negative in 2017 as employers have limited ability to offer more generous pay rewards.

“The situation again highlights the need for more employers to focus on workplace productivity improvements in order to be able to afford more generous basic pay increases, especially against the backdrop of a further increase in the National Living Wage (NLW) in April. Indeed, it seems that the National Living Wage has provided a modest boost to earnings since its introduction, partly because many organisations have sought to maintain pay differentials between those directly affected by the new rate and their managers or supervisors. In addition, the NLW has acted as a catalyst for productivity improvements in some organisations, but fewer than the proportion who said they would offset the increase in wage costs through productivity improvements prior to the introduction of the policy.”As a result, the main response from employers during the first six months of the National Living Wage was to absorb the cost”

EU Nationals and Brexit

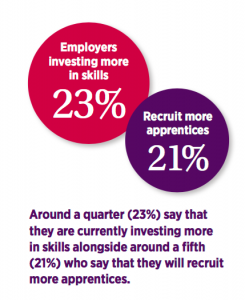

The CIPD note that their are early indications that employers are finding it tough to hold on to their staff. Overall, almost one in three (29%) employers say that they have evidence that shows that EU nationals looked to leave their organisation and/or the UK as a result of the vote in 2016, and a similar proportion (27%) say that EU nationals are considering leaving their organisation and/or the UK in 2017. This is consistent with official data.

“In addition, it has been suggested that greater investment in skills and physical capital may increase as a result of a reduction in the supply of EU nationals. However, the survey data suggest

that we have seen a modest fall in investment, despite the prospect of changes to the Government’s immigration policy. In addition, it also seems that employers are keen to divert more effort towards recruiting more younger and older workers to offset the labour shortage problem rather than increase pay”

Overall, there is some uncertainty about whether employers can offset the implied risk of a fall in the supply of EU nationals in the year ahead with a greater focus on recruiting UK nationals, without raising pay, against the backdrop of a strong demand for labour.

About the CIPD

The CIPD is the professional body for HR and people development. The not-for-profit organisation champions better work and working lives and has been setting the benchmark for excellence in people and organisation development for more than 100 years. It has more than 140,000 members across the world, provides thought leadership through independent research on the world of work, and o ers professional training and accreditation for those working in HR and learning and development.